If you’re one of those inhabiting Utah in your golden years, taxes are probably the last thing on your mind. Here’s what you need to know about Utah retirement taxes, from retirement income tax to pensions, 401ks, Social Security, and more!

Before we get started, we are financial advisors in Davis County, Utah and we have written these blogs:

Enjoy!

And now onto the blog…

Does Utah tax retirement income?

The simple answer: yes, Utah does tax retirement income.

Distributions tax

If you have saved money in a retirement account such as an employer-sponsored retirement plan (401k, 403b, etc.) or IRA, you’ll have to take your Required Minimum Distributions (RMDs) at age 73. In Utah, you pay tax on 401(k) withdrawals and distributions from any other type of qualified retirement plan.

But what tax do I pay on these distributions?

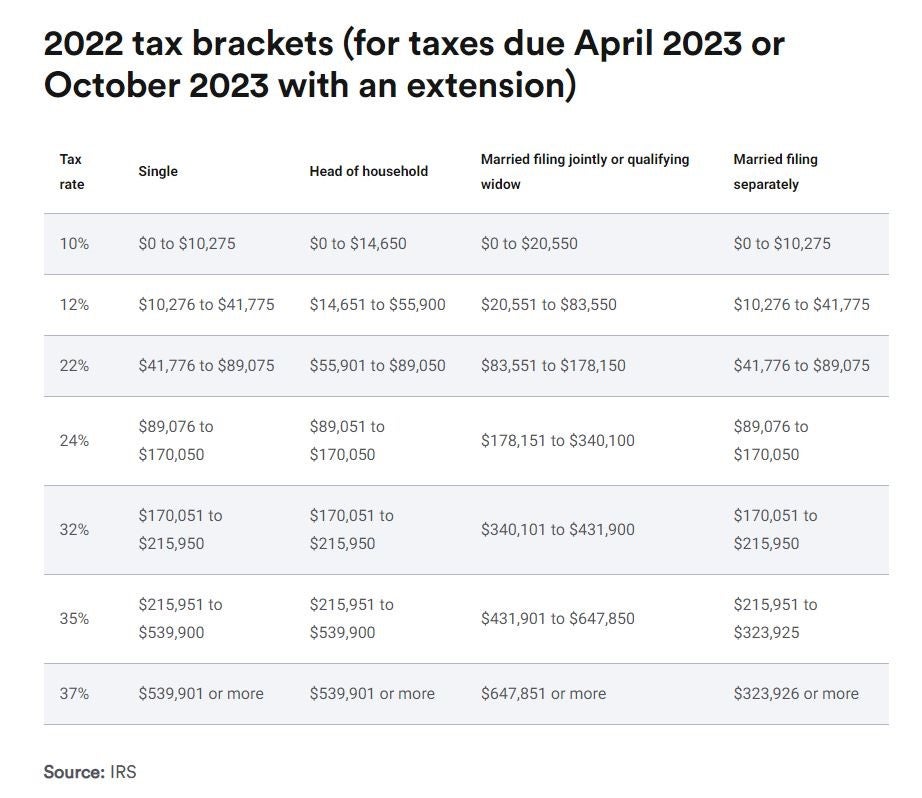

You are liable to pay ordinary income tax at the income tax rate that would apply to you. The table below from Bankrate outlines these rates.

There is no way to tell in advance the specific amount of retirement tax you will pay in Utah, but you can get a general idea using these tables.

Tax on dividends and interest

In addition, you’ll pay either the income tax rate on your dividend and interest income produced by any securities held in taxable account.

Capital gains tax

Should you sell a security at a gain in a taxable account, you’ll pay capital gains tax on the amount of the gain assuming you held the security for more than a year. Securities held for less than a year before being sold for a gain will be taxed at your ordinary income rate. Unfortunately, there is no Utah retirement tax credit. There are only a handful of states that will allow you to forgo these sort of taxes, and Utah is not one of them.

Does Utah tax pensions?

A pension is defined as an annuitized stream of income offered by an employer in exchange for salary deferrals that you contributed to their defined benefit plan over the span of time that you worked for that company.

When you start to receive your pension, the payments are taxed at the ordinary income tax rate (see tables above). If you are a resident of Utah, you will pay tax on your pension income.

If you roll over your pension to a qualified account such as an IRA, you will not pay tax until you take distributions from the account you rolled the pension into.

Utah and Social Security tax

We discuss the definition of Social Security in our blog about how these benefits work for widows. Social Security tax in Utah follows the protocol for the rest of the country.

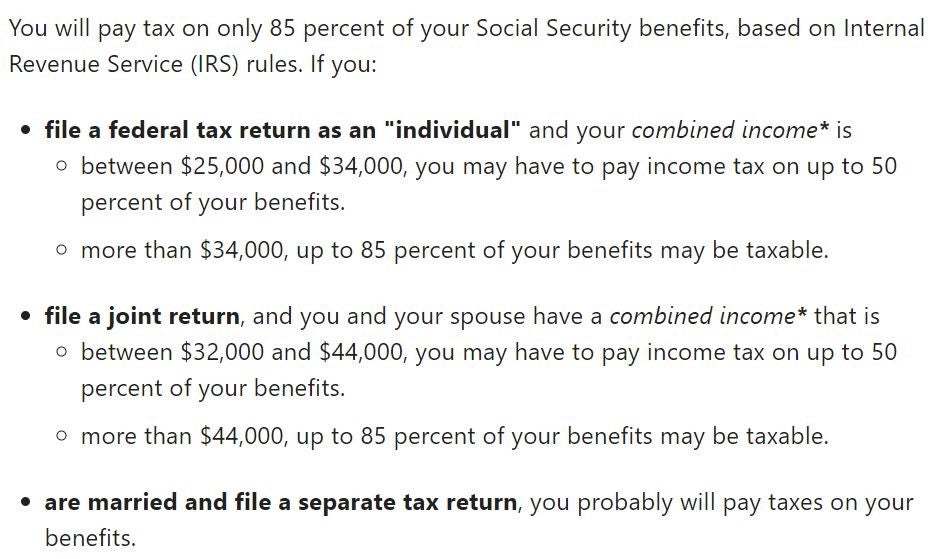

Social Security benefits are taxed at the ordinary income tax rate. To determine how much of your income is taxed, see the guidance below from the Social Security Administration.

For questions related to your specific tax situation, it’s always best to consult with your CPA or tax advisor. Please note that all guidance here is general in nature and cannot be interpreted as advice specific to one individual.

How to reduce taxes in retirement

If what we’ve said in this blog so far has got you fearing the tax reaper, here are ways to reduce your taxes in retirement.

Charitable contributions

Once you turn 70.5, you become eligible to make a Qualified Charitable Contribution (QCD). A QCD allows you to make charitable contributions directly from your IRA and avoid that taxable income. This could also free up monthly/annual cash flow that you would normally be donating to charity. If you are still under 70.5, you can avoid paying capital gains tax by donating appreciated stock to charity.

For other ways to reduce tax by donating to charity, read our blog.

Roth conversion “sweet spot”

If you are retired (and hence in a lower tax bracket) but not yet taking Social Security, or have some room in your current tax rate bracket, it may be a good idea to perform a Roth Conversion.

Using a Health Savings Account

A health savings account, or HSA, can help with medical expenses in retirement at the same time as reducing your tax bill. This is an investment account that you can contribute to pre-tax. You get a full tax deduction for the amount you put into your account, and the money grows tax-free.

You can either save it, spend it on qualified medical expenses, or invest the proceeds. If you spend the money on qualified medical expenses, you won’t have to pay tax on it.

Strategic management of non-retirement assets

Retirement accounts allow assets to grow tax deferred, while non-retirement accounts do not. They are taxed each year on the interest, dividends and realized gains via tax from 1099 and, therefore, need to be managed in a very tax-sensitive way on both the equity and fixed income side.

It is also logical to supplement Roth/non-retirement money with pre-tax dollars to stay in lower tax brackets. If you have an unexpected expense come up and you are up against the next tax bracket, you may be able to supplement that expense with Roth/taxable money so you don’t bump yourself into a higher tax bracket.

Summary on Utah retirement tax

Overall, Utah is a pretty tax-friendly state for retirees. As financial advisors in Davis County, Utah, we help our clients with tax planning, financial planning, and saving for retirement.

If you’d like to talk, please set up a time below.

Zach Nelson CFP® is a financial advisor for solo entrepreneurs.

Sources

AARP. Waggoner, John. (12 January, 2023). 12 States That Won’t Tax Your Retirement Distributions. https://www.aarp.org/money/taxes/info-2023/states-that-do-not-tax-your-retirement-distributions.html

Bankrate. (17 January, 2023). 2022-2023 tax brackets and federal income tax rates. https://www.bankrate.com/taxes/tax-brackets/#tax-bracket-2022

Social Security. Income taxes and your Social Security benefit. https://www.ssa.gov/benefits/retirement/planner/taxes.html

Disclosures

The materials in this blog are for informational and educational purposes only. The material should not be considered tax or legal advice and is not to be relied on as a forecast. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. The material is also not a recommendation or advice regarding any particular security, strategy, or product. Investing involves risk, including the possible loss of principal. Investors should carefully consider a fund’s investment objectives, risks, charges, and expenses. Content is current as of the publication date or date indicated and may be superseded by subsequent market and economic conditions.