Have you ever had a period of time when you had tons of medical expenses? I recall one time a friend’s brother was rocking out on stage, and a guitar crashed into his forehead. Medical expenses were spectacularly high that year! In this article we’ll talk about what health savings accounts are and how to know whether or not it may be worth it to use one.

Before we get into the blog, here are some other articles we’ve written:

Healthcare costs in retirement

Retirement planning for high net worth investors

And now onto the blog!

Health savings accounts – defined!

Let’s start off by answering the basic question. What are health savings accounts?

A health savings account, or HSA, can help with medical expenses and also with taxes. It is an investment account that you can contribute money to on a pre-tax basis, with the option to either save it, spend it on qualified medical expenses, or invest it.

If you are looking for a way to save money on taxes, a Health Savings Account should be on the top of your list.

But – there are some important qualifiers here.

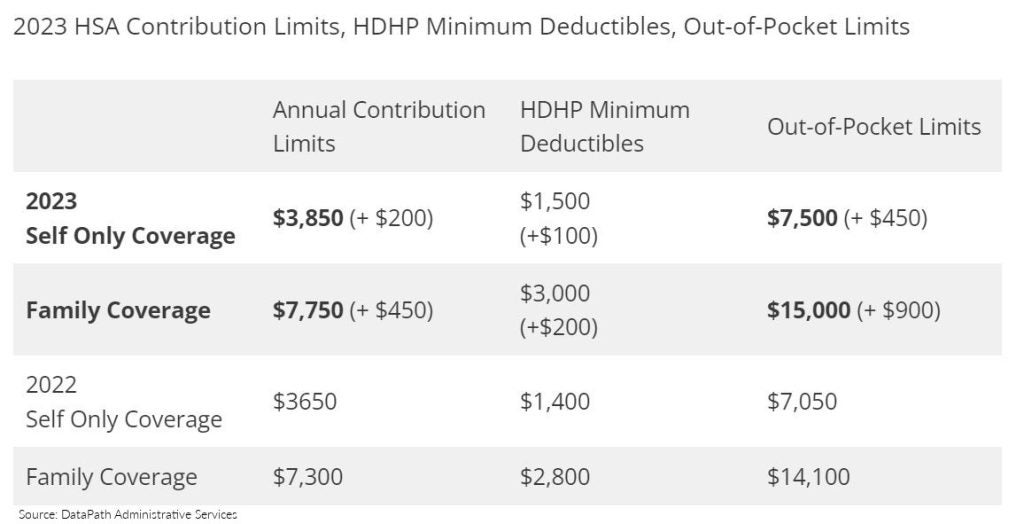

- To be eligible for an HSA, you need to have a high deductible medical insurance plan. There are different limits that apply. In 2022, the HSA limit was at least $1,400 for an individual or $2,800 for a family, according to HealthCare.gov.

- In addition, every year there is a limit on how much you can put into your HSA. These limits are set by the IRS.

Heath savings accounts and tax deductions

You get a full tax deduction for the amount you put into your HSA. If you invest it, the money grows tax free. As long as you use the money in the account for qualified medical expenses, you will never pay tax on that money.

Check out our podcast on Health Savings Accounts below.

What can you use it for?

First you need to determine what your goal is for the account:

- Use it now for current medical expenses

- Save it to use as an emergency medical fund

- Invest it for medical expenses in retirement

Spend it now

If you choose to spend the money in your HSA, it has to be used on qualified medical expenses. You pay out of pocket for the care, and then reimburse yourself from the HSA account.

Your HSA provider should have a list of eligible expenses. See here for an example from CIGNA.

- In some cases, we have been surprised to find that certain expenses such as eyeglasses, birth control, IVF, band aids, copays, and LASIK surgery were reimbursable.

- However, it cannot be used to pay for your healthcare premiums until age 65. Once you turn 65, your HSA can be used to pay Medicare premiums. It cannot be used for supplemental, or Medigap, policies.

If you do spend it, it’s important to keep cogent records so that you have proof of what the proceeds of the account were used for.

This is potentially a great way to pay for kid’s braces, co-pays, dental work, etc. with pre-tax dollars. Even if you are going to take the money right out, you should still put it in your HSA first to get the tax benefit.

Save it for an Emergency

Remember that within the definition of a health savings account is the quality of being able to keep the money there indefinitely. You can leave the money in an HSA indefinitely. This is a key difference between an HSA and an FSA, or a Flexible Savings Account.

If you don’t spend the money in an FSA by the end of the year, you lose it. With an FSA, however, you don’t have to use a high deductible insurance plan to qualify.

If you don’t have a lot of medical expenses now but you want to be able to access the money in case of an emergency you should leave it in cash.

Invest It

If you choose to invest your HSA account, make sure you won’t need it until later. If you are going to use it to spend within 1-3 years, it’s best to leave it in cash. However, if you probably won’t be touching it for longer than that, it may make sense to invest it.

If you are using your HSA as an emergency medical expense account, try to keep at least two years of out-of-pocket expenses in cash. Most HSA providers allow you to set your target cash limit and then it will automatically invest the amount above your target.

If you have an adequate emergency fund held elsewhere and you can pay for medical expenses out of your cashflow or from other savings, consider using the HSA as another retirement savings account. You can invest your HSA similar to your other retirement accounts. If your HSA custodian does not provide investment options, you may need to consider moving to a new custodian to use this strategy.

According to a Fidelity study , the average retired couple will pay over $300,000 in medical expenses (2022). Using an HSA as an investment account for the long term, to help you pay for some of those medical expenses when retired, may be a smart move and will save you on taxes.

Due to the potential for tax savings and tax-free growth in the HSA, we see using the HSA as a retirement savings account as having the ability to be highly effective in certain cases. However, everyone’s situation is different and you need to evaluate what is best for you.

Reimburse Yourself From Your HSA

You are also able to use your HSA is to reimburse yourself for past expenses. These qualities must apply:

- You must have had to have your HSA before you had those expenses.

- You must not have received a tax deduction previously for those expenses.

Here are some examples of how individuals have used an HSA to their advantage.

Example 1: Jane opened an HSA in 2015 and started contributing. She planned to save the money in her HSA for retirement. She paid for medical expenses out-of-pocket and invested the HSA and let it grow. In 2020, she lost her job and needed some cash. She had kept her medical bills since 2015 totaling $9,000 and was able to draw out money from her HSA to reimburse herself in 2020. Her investments were down at the beginning of 2020; but by the end of the year the investments had recovered. She waited to withdraw at the end of the year after using her emergency fund.

Please note: markets can be volatile so you need to be careful about the timing of withdrawals if you are investing the HSA. Also, if you are investing your HSA, you should have an emergency fund savings account or you should keep some of the HSA in cash. Aim to save at least two years of your insurance out of pocket cost.

Example 2: Lon had a big surgery that cost him $12,000 out of pocket even after negotiating the cost down. He only had $8,000 in his HSA. He used all of it and paid the remaining $4,000 from other savings. This allowed him to pay $8,000 with pre-tax dollars. Then the next year after he had rebuilt his HSA, he pulled out $4,000 to reimburse himself for the money he paid from his other savings account. Effectively, Lon paid for his whole surgery with pre-tax dollars.

Other items to be aware of:

- After age 65, the HSA works like an IRA. You can use it on any expense but you have to pay the tax if it isn’t a medical expense. Don’t do that though; you are turning tax-free money into taxable money. You will likely have plenty of medical expenses to use up your HSA in retirement, such as your Medicare premiums. Work with a financial advisor to determine how you should aim to save in your HSA for retirement.

- If you don’t use it before you die, it can be passed on to beneficiaries. They will need to pay the tax on the money still in the HSA.

- If you have Medicare you cannot contribute to an HSA

- If you are no longer on an HSA compatible insurance plan you can still keep the HSA with what you have contributed, but can no longer add money to it.

- If your adult child under 26 is on your health insurance, they can open their own HSA and contribute in addition to you contributing to your HSA. The important qualifier is they cannot be claimed as a dependent on your taxes. If you have a family plan, they can contribute the family maximum to their own HSA. For example, for 2022 Mary and John contribute $7,300 to their HSA and get the tax deduction. They gift $7,300 to their son Roger, (who is 22, and on their health insurance), and he contributes it to his HSA and claim the deduction on his taxes.

- After age 55, you can contribute an additional $1,000 to your HSA. If you have a family plan and both yourself and your spouse are over 55, you can add $1,000 each. But you cannot add it to the same HSA. You can add the family maximum, plus $1,000 to your HSA and your spouse will need to go open a new HSA and put their $1,000 in a new account.

- You are only eligible to contribute to an HSA for the months you are covered on an HSA. For example, Justin turns 65 on September 20, 2022 and will go on Medicare. He can contribute for the first 8 months of 2022 only. The maximum for 2022 since he is over 55 is $4,650. But his maximum for 8 months of coverage is $3,100.

- You have until the tax filing deadline in April of the subsequent year to contribute to your HSA. For 2022, you have until April 18,2023 to contribute.

Is an HSA right for you?

We know everyone’s situation is different, so it’s prudent to reflect and figure out the situation that works best for you and how to use the HSA for your benefit. There are many different uses, each with different short and long-term benefits.

There are a number of factors to consider and health plans should be selected upon your medical needs first (doctors, ease of access, etc.) If you have a lot of prescriptions and medical expenses, perhaps a lower deductible plan is right for you.

However, if you do determine that a health savings account is the right way to go, when picking a health insurance plan during open enrollment, make sure you ask your insurance company if the plan you are choosing is HSA compatible. It has to say that explicitly; don’t assume that all high deductible plans qualify.

It’s only one part of the equation…

Did we answer your question about what health savings accounts are? Savings vehicles like these are only one component of an overall financial plan.

At Rock House Financial, a fee-only financial advisor in Davis County, Utah, financial planning is the focus. If you would like to speak with us, please reach out.

Sources

CIGNA. Which Expenses are Eligible for HSA, FSA, and HRA Reimbursement? https://www.cigna.com/individuals-families/member-guide/eligible-expenses

DataPath Administrative Services. IRS Announces 2023 HSA Limits. https://datapathadmin.com/2023-hsa-limits/

Fidelity Viewpoints. August 29, 2022. How to plan for rising health care costs

https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs

HealthCare.gov. High deductible health plan (HDHP). https://www.healthcare.gov/glossary/high-deductible-health-plan/

IRS. 26 CFR 601.602: Tax forms and instructions. https://www.irs.gov/pub/irs-drop/rp-22-24.pdf

https://www.optum.com/content/dam/optum/consumer-activation/unknown/Adult_Child_Parent.pdf

Disclaimers

Case studies presented are based on actual clients, however, the information has been changed or altered for anonymity. These studies are provided for educational purposes only. Similar, or even positive results, cannot be guaranteed. Each client has their own unique set of circumstances so products and strategies may not by suitable for all people. Please consult with a qualified professional before implementing any strategy discussed herein.

No portion of these case studies is to be interpreted as a testimonial or endorsement of the firms’ investment advisory services.

Rock House Financial (RH Advisors) throughout this website has provided links to various other websites. While the firm believes this information to be reasonably reliable, current and valuable to its clients, The firm provides these links on a strictly informational basis only and cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.