It may seem straightforward, but there are many complicated dimensions regarding Social Security for widows. In this blog, we’ll discuss the “Widow’s Gap” and how widows can overcome it, as well as many other questions that widows tend to have about this benefit.

Before we get started, we are financial advisors for widows. We’ve written other blogs on this topic which you can read below.

The complete guide to losing a spouse who owns a business

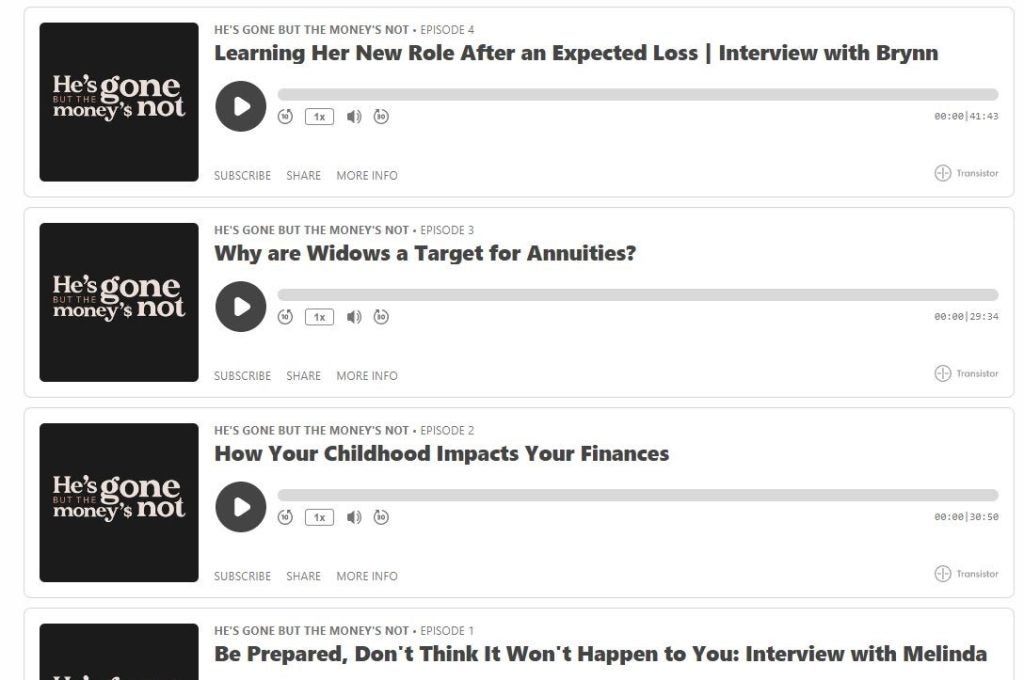

We also have a podcast for widows that you may enjoy.

And now onto the blog!

What is Social Security?

Before we get into the topic of Social Security for widows, let’s start at the beginning by discussing what Social Security benefits actually are, in a general sense. Although people are always talking about Social Security, there are often more subtle points that can be missed.

At a high level:

Social Security is a benefit administered by the United States government that was designed to replace part of your income that is missing when you stop working. In the years you are working, you pay tax into the system. When you retire (or if you were to become disabled), you are entitled to those benefits.

Full retirement age is currently age 66 in the United States. If you wait until full retirement age, you receive 100% of the benefits you’re entitled to. But if you take it earlier than that, your benefits are reduced.

Simple, right?

But then what’s the issue with widows and Social Security?

If your spouse were to become deceased, you have a claim on his or her Social Security benefits as long as you were married for at least nine months (this is called Social Security Survivor Benefits). But, there are many details that come into play which determine how much you’ll be getting.

Let’s dive in!

Widows and Social Security

How does Social Security work for a widow?

On first blush, it may seem like a simple exercise to figure out how Social Security works for widows.

- You get $255 as a one-time death benefit if your spouse passes away. This is paid out first before any other benefit.

- If your spouse passed away before filing for Social Security, you receive the greater of either your benefit amount, or your spouse’s.

- If your spouse passed away after filing for Social Security, you receive the greater of either your benefit amount, or the amount your spouse would have received if they filed on the day they passed.

Those are the basics…but as we all know, real life is more complicated than that. Let’s look at some of the scenarios that typically occur that influences how much of a Social Security benefit a widow can get.

We’ve explored the following topics on

our widows and Social Security podcast which you can access here:

Part 1: Social Security Basics

Part 2: Social Security Survivor Benefits

Timing of Social Security

When can you start drawing your own benefit?

- Earliest age 62, will be reduced as this is considered an early withdrawal

- 100% benefit at full retirement age which depends on your birth date

- Can delay until age 70 to let your benefit grow

When can you start drawing a survivor benefit?

- Earliest age 60, will be reduced as this is considered an early withdrawal

- 100% benefit at full retirement age which depends on your birth date

- If delayed past full retirement age there is no additional benefit

You can switch between benefits if you are eligible for survivor benefits. For example a widow may start drawing a reduced survivor benefit at 60 and then at 70 switch to her own benefit, which has now grown and earned delayed credits. Typically you would want to grow whichever benefit is the highest.

Keep in mind all Social Security benefits are subject to an earnings test. If you start taking your own benefit or a survivor benefit when you are younger than your full retirement age and have earned income your benefits may be reduced. If you earn over $21,000 for 2023 your benefits will start to be reduced $2 for every $1 over the limit.

Remarrying and Social Security

If you are a widow thinking about getting remarried, you must wait until age 60 to remarry if you want to be eligible for your deceased spouse’s Social Security benefit. If you were to remarry before that, you would qualify for your new spouse’s benefit.

What if you are a widow with children?

If you have dependents in the home, you are eligible for 75% of your deceased spouse’s full retirement age Social Security benefits. If you are working, you can not earn more than a certain amount – a little more than $21,000 in annual salary for the calendar year 2023 – or your benefits are reduced. When your youngest child turns 16 years old, the benefits turn off. You can no longer collect these survivor benefits until you turn 60.

You may need to plan for this loss of income, if you are not planning to work. Everyone has to make their own decision. It can be pretty important to maintain a job for the purpose of having health insurance. You also may be better able to support your family with your earnings from work.

What if I am a widow with children?

Your dependents may receive a Social Security benefit and there is an earnings limit for them as well, although most kids don’t have to worry about making more than this limit of $21,000. Their benefits continue to age 18 (or 19 if they have not graduated from high school). They get 75% of their deceased parent’s benefit. That benefit is taxable to the child; it is separate completely from your own income.

If the child has a disability that onset before age 22, their survivorship benefit continues for as long as they live. It does not terminate at age 16. If you are a caretaker for a disabled child, your benefit also continues for as long as you are taking care of them. It will not stop when the child turns age 16.

The Social Security Administration sets a cap on how much benefit you can receive as a family. The limit is 150 to 180% of the deceased full retirement amount, depending on how many people are in your family. This limit applies to the survivor benefit and the kid’s benefit.

Here is key point about how survivorship benefits are taxed:

- Your benefit as a widow is taxable to you.

- Your children’s benefits are taxable to them.

Seems straightforward but many fail to recognize this.

Young widows

Let’s say you were a young couple that was in school and didn’t work much. Even if you haven’t paid in much to Social Security, it is likely that you can still get benefits. The younger you are, the less you need to have worked. Usually, you have to have worked for 10 years but the Social Security Administration may provide some type of benefit in these cases in order to not penalize the families of people who died young.

Divorced widows

If you are divorced, your claim on your ex-spouse’s Social Security benefits is:

- Half when the spouse is alive,

- 100% when the spouse dies

However, a few caveats apply. You must have been married for 10 years and you must not have remarried. You cannot claim these benefits until age 62.

Windfall Elimination Provision (WEP)

The WEP affects people who worked in jobs in which your earnings were not subject to payroll tax. Examples would be working for a non-profit or working outside the country for some time and moving back to the US. Benefits are reduced in this case to avoid overly substantial payments to workers whose earnings were not covered by Social Security for a prolonged amount of time.

Government Pension Offset (GPO)

The Government Pension Offset applies if you or a spouse are receiving a pension from the government, but did not pay into Social Security while working in such a role.

And last but not least, there’s one more (not so minor) factor to consider – when your deceased spouse started taking their Social Security payments. This is where the “Widow’s Cap” comes in.

The Social Security Retirement Insurance Benefit Limitation

It gets a bit complicated if your spouse filed for Social Security before they reached full retirement age. If they took a reduced benefit, your benefits may be reduced. In this case, you are entitled to the greater of either the benefit amount that they were receiving, or 82.5% of the benefit your spouse would have received if they had filed at full retirement age.

This is what people refer to as the “Social Security Widow’s Limit.” Its technical term is the Retirement Insurance Benefit Limitation (“RIB-LIM”). In colloquial terms we call it the “Widow’s Cap.”

In other words, because your spouse filed early, you will never be able to receive more than 82.5% of the amount he would have received if he had waited until full retirement age. This is important for a widow to know if you are planning to wait to draw survivor’s benefit and let it grow; it may be a futile wait because the benefits are capped. Depending on the situation there may be no benefit to delaying past the survivor’s age of 62 or 63. To a widow depending upon her deceased spouse’s income as a way to fund her living expenses, this could be quite a serious drawback. That is one of the reasons why it’s of high importance for widows to have a financial plan.

A widow’s guide to financial survival

Wow, so that was a whirlwind!

With all these details to consider, how does a widow figure out how to make it financially?

Losing a spouse is not to be taken lightly from a financial perspective. Becoming a widow raises the risk of living in poverty. Financial planning is not on the list of immediate tasks for a widow to complete right after losing a spouse, but it’s essential as a medium to longer term priority.

A financial plan for a widow should address the following:

- Taxes/tax planning

- Budget

- Cash flow

- Retirement income planning

- Retirement strategy

- Risk management/insurance

Through careful retirement income planning and strategy, loss of a spouse can be managed to the fullest possible extent. Social Security can be complicated in situations where a spouse has become deceased, and sometimes even the Social Security Administration can be confused on these topics. Getting the right guidance is critical.

There are financial advisors who specialize in working with women in transition after the loss of a spouse. At Rock House Financial, a fee-only financial advisor in Farmington, Utah, we have financial advisors for widows as members of our team. If you would like to speak with us, please reach out.

Thanks for reading, and before you go please check out our podcast for widows.

Nicole Roberts CFP® is a financial advisor for widows, divorced, and single women.

Sources

Devin Carroll. (2018, November 18th). YouTube. [Video]. Secrets of Survivors Benefits: The Widows Cap. https://www.youtube.com/watch?v=LUb0Zo8TSug

Social Security. Starting Your Retirement Benefits Early. https://www.ssa.gov/benefits/retirement/planner/agereduction.html

Usa.gov. Social Security. https://www.usa.gov/social-security Weaver, David A. (2001, June). Division of Economic Research, Office of Research, Evaluation, and Statistics, Office of Policy, Social Security Administration. The Widow(er)’s Limit Provision of Social Security. ORES Working Paper No. 92. https://www.ssa.gov/policy/docs/workingpapers/wp92.html

Disclosures

Rock House Financial (RH Advisors) throughout this website has provided links to various other websites. While the firm believes this information to be reasonably reliable, current and valuable to its clients, The firm provides these links on a strictly informational basis only and cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.