At Rock House Financial, we believe that giving to charity is a wonderful thing. Not only are you enhancing the lives of others and making the world a better place, but you’re taking a stance for what you believe in. This type of action deserves to rewarded. The IRS agrees. While most people are aware of the potential tax benefits they can receive in return for donating, many don’t know that there are several ways to do so. Investors who are interested in adding charity to their financial repertoire will be pleased to learn that there are several strategies that can be used to give more effectively while maximizing their tax benefits. Below are six alternative strategies you may not have considered. (Business owners may have additional options.)

Take note that not all investors may have the same or similar tax structures and may need to consult an accountant prior to implementing charitable donations for tax purposes. Consulting with a financial advisor and tax professional can help you know what strategies would work for your situation.

Give Long-Term Appreciated Securities

If you’re donating cash, you may be missing out on financial benefits. At Rock House Financial, we talk to a lot of our clients about donating investments instead of cash, such as shares of stock that have grown over time. Donating stock can boost your tax savings and can potentially help you avoid capital gains taxes.

Here’s why:

When stock is donated to a charity, the owner is eligible to deduct the fair-market value of the investment up to 30 percent of their modified Adjusted Gross Income. What’s more, since you aren’t selling the investment, you don’t incur capital gains taxes when you make the donation. Capital gains taxes are primarily determined by how long you owned the stock and your income level.

If you have held a stock for more than a year (described as long-term) and will earn between $78,750 and $434,555, you would pay 15 percent in taxes. For this example, donating stock would automatically result in a tax savings of 15 percent. If you have experienced a high amount of potential gains, donating some of your holdings can lower your tax burden.

Based on the tax benefits mentioned above, you can become selective about the stocks you donate. Of course, donating the stocks you own that have the highest potential for capital gains taxes is a solid choice. You likely have more options than you think when making donations, so be sure to speak with your financial advisor about taking this route. This can be a complicated decision you may not be equipped to make on your own.

Let’s talk! As we approach the holidays and, for many, the season of giving, contact Rock House Financial to discuss your options.

Donate to a Charity Directly with QCDs

Retirement account withdrawals, referred to as distributions, are treated as income, and therefore, are subject to income taxes. However, sending money from a retirement account directly to a charity in the form of a Qualified Charitable Distribution (QCD), eliminates the tax consequences of the distribution.

QCDs also count toward your Required Minimum Distributions (RMDs). If you own a pre-tax retirement account like a Traditional IRA, SEP IRA, 401(k) or the like, you must make a RMD each year once you turn 72. Previously, the age was 70-½ but this was changed by the SECURE Act of 2019. This transaction is taxable. Fortunately, making a QCD removes the tax consequences of your RMD as well.

Sending money directly to a charity from your retirement account – meaning the money never touches your personal bank or investment accounts – can likely eliminate the taxable income of the withdrawal.

The COVID-19 Impact on QCDs

Keep in mind that due to COVID-19, the Coronavirus Aid, Relief, and Economic Security (CARES) Act removed the requirement to take RMDs for 2020, so you aren’t required to make your annual withdrawal this year.

Establish a Donor Advised Fund

A Donor Advised Fund (DAF) is a separately identified fund or account that is maintained and operated by an official 501(c)(3) organization. Once you make a contribution to this account, you receive an immediate tax benefit, and the charitable organization has legal control over it.

These account types are becoming very popular, and have more than doubled over the past five years, due to their convenience and tax effectiveness. Talk with the fiduciary financial advisors at Rock House Financial to see if this strategy will work for you.

Not only are DAFs easy to use, but they offer a full menu of tax benefits. If you donate cash or securities to a DAF, for example, you can make deductions to each of 60 percent and 30 percent, respectively. Plus, since the organization owns your securities officially, you will not be subject to capital gains taxes or estate taxes, while the investments (if applicable) grow tax-free.

A minor caveat to DAFs is that you must itemize your deductions for the year instead of simply taking the standard deduction. Be sure to work with a tax professional if you consider opening a DAF account.

Donate Complex Assets

If you own complex assets, you can still think strategically when donating to charity. Complex assets are defined as assets that are somewhat illiquid and cannot be sold and converted to cash extremely quickly. This includes assets like artwork, non-traditional real estate and even more alternative assets like non-publicly traded stock, foreign investments and intellectual property.

While these assets can be difficult to sell, they still offer tremendous value to charities – and your taxes. Donations can be easily made using a DAF or by working with a foundation directly (they usually have their own form you can fill out). Each asset virtually has its own set of rules, so be sure to consult with your financial advisor before donating a complex asset.

When you do donate complex assets through these channels, you may be able to avoid capital gains tax on gifts of appreciated assets. You can likely receive the maximum tax deduction allowed by law for your donation. No matter how complex an asset may be, consult your tax advisor to see if you can obtain a tax benefit through a charitable donation.

Create a Charitable Trust

Charitable trusts are groups of assets that a donor legally donates or uses to create a fully charitable foundation. The assets, which are usually liquid, are held and managed by the charity for a specified period of time, with some or all interest that the assets produce going to the charity.

The tax benefits are usually realized in years when donations are made and may be a good fit for a person with an unexpected spike in their annual income to take a charitable donation in the same year.

There are 2 types of charitable trusts; each one is irrevocable and stipulates a different format pertaining to timeframe or ownership.

Charitable Remainder Trust (CRT)

A CRT is designed to generate income for the donor (or other beneficiaries), with the understanding that the donated assets will ultimately transfer to the sole ownership of your chosen charity after a predetermined period of time.

You can still personally receive income from your investments for a predetermined number of years. But, since the asset will be owned by the charity when the time period ends, you are not responsible for the capital gains taxes or estate taxes.

Charitable Lead Trust (CLT)

A CLT works in the opposite fashion, mirroring a CRT. This charitable setup provides immediate support to your charity through pre-determined fixed payments for a specific period of time.

At the end of the term, the trust will revert to the benefit of your loved ones by transferring all of its remaining assets to your heirs. As opposed to CRTs, CLTs generate income for your charity, but are later retained by your family.

‘Bunch’ Charitable Donations

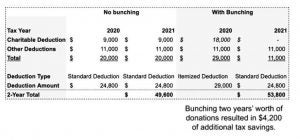

Bunching is a strategy in which you combine tax-deductible charitable contributions into a single tax year, instead of spreading them over two or more years (illustrated below).

This strategy is mostly driven by the tax law changes from the Tax Cuts and Jobs Act of 2017, which (among many sweeping tax changes) doubled the standard deduction, which may lower the incentive to itemize deductions. Bunching donations aims to obtain the benefits of itemizing in some years and taking the standard deduction in other years.

Here’s an example:

Using the standard deduction only (without bunching)

Suppose a married couple completes $20,000 of annual itemized deductions, which includes a $9,000 donation that goes to a qualified charity or an individual DAF. That amount falls short of both the $24,400 standard deduction in 2019 and the $24,800 standard deduction in 2020. In this case, the couple should take the standard deduction each year instead of itemizing. After two years, that adds up to a total of $49,200 in standard deductions.

Using the bunching strategy instead

Using the same example above, suppose that the couple combined two years’ worth of donations into a single year. Instead of only giving $9,000 to charity each year, the married couple “bunches” their charitable donations into a single year, for a total of $29,000 ($18,000 plus $11,000) in itemized deductions in 2019, and takes $24,800 standard deduction in 2020. Over the two years, the couple would have $8,600 of additional tax deductions.

Your Assets Are Your Tax Advantage

No matter your financial situation, you likely have a number of charitable giving strategies at your disposal. If you are interested in becoming more charitable, or if you’re already charitably inclined, talk with the fiduciary financial advisors at Rock House Financial to make sure you’re utilizing the strategies that will boost your giving and tax benefits. You just might unlock tens of thousands of dollars in new tax savings!