So you get a letter in the mail that you are the recipient of Maverik stock appreciation rights. “Cool!” you say, “But what exactly is that?” In this blog we’ll cover the ins and outs of these vehicles, and the tax implications you should have aware of.

What are Stock Appreciation Rights?

Let’s start with an explanation of exactly what it means for you to be the holder of Maverik stock appreciation rights. Stock Appreciation Rights (SARs) are a type of employee incentive plan that companies use to reward their employees for the company’s financial success. SARs are similar to stock options, but they don’t involve the actual issuance of shares. Instead, they provide employees with the right to receive the appreciation in the company’s stock value over a predetermined period.

Here’s how Stock Appreciation Rights work:

- Granting SARs: Maverik grants SARs to employees as part of their compensation package.

- Exercise Price: SARs have an exercise price, which is the market price of the company’s stock on the grant date. This is the baseline value from which any appreciation will be calculated.

- Vesting: SARs often have a pre-determined vesting period, a set amount of time in which the employee needs to remain with the company before he or she can exercise their rights.

- Exercise: Once the SARs have vested, employees can exercise them. When they do, they receive the cash or the equivalent value of the appreciation in the Maverik company stock price from the grant date to the exercise date.

- Cash Settlement: Unlike stock options, SARs are settled in cash. The employee receives the monetary value of the appreciation rather than actual shares of Maverik stock.

How Do I Minimize the Tax Burden?

When you exercise Maverik SARs that are settled in cash, you will receive a cash payment equal to the appreciation in the stock’s value. This cash payment is considered ordinary income and is subject to ordinary income tax rates. It’s crucial to consult with a tax professional and/or your financial advisor to get personalized advice based on your specific situation and the tax laws applicable to your jurisdiction.

Let’s take a look at some potential tax planning strategies:

Max Fund 401(k) Plan

Traditional 401(k) contributions are made on a pre-tax basis, meaning the money you contribute is deducted from your taxable income for the year. This can help offset some additional income in the year your Maverik SARs are exercised. How much can you put into your Maverik 401(k) plan? The 2023 contribution limit for a 401(k) plan is $22,500 plus an additional $7,500 for participants 50 and older. In 2024, those limits will increase to $23,000 plus an additional $7,500 for participants 50 and older.

The upfront deduction and tax-deferred growth on the money make this simple option very attractive. Add in a company match on top and it’s a no brainer.

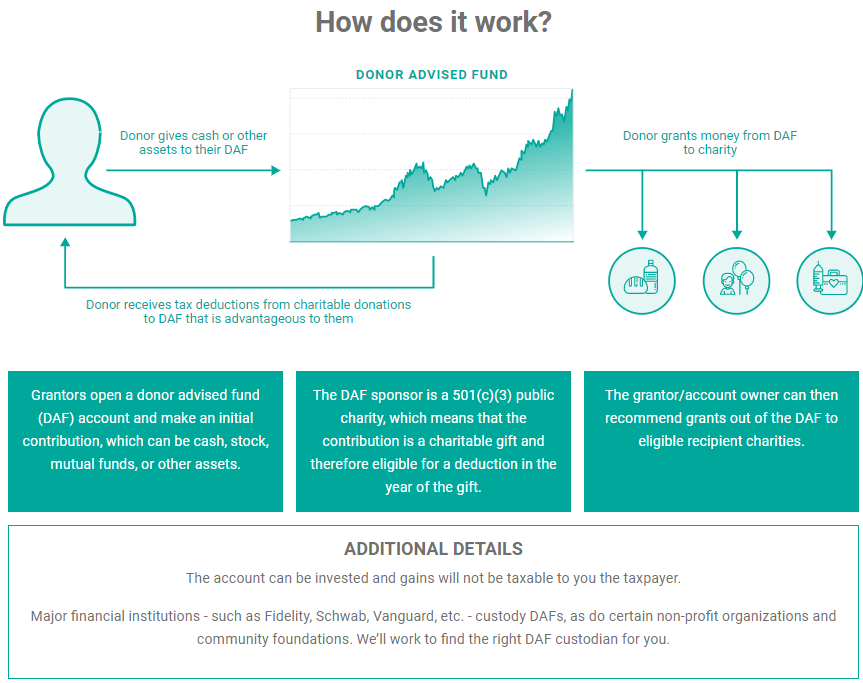

Utilizing a Donor Advised Fund (DAF)

A Donor Advised Fund (DAF) is a separate account that is maintained by a 501(c)(3) organization. You receive an immediate tax benefit for federal and/or state income tax purposes in the year you make the contribution. Also, once you donate to a DAF, the DAF provider has legal control over it, and is the legal owner. However, the DAF provider allows the donor to advise on how proceeds are donated to the charities of your choice and, sometimes, how funds in the fund are invested. Here’s some good news – because you are no longer the owner, you will not be subject to capital gains taxes or estate taxes, while the investments (if applicable) grow tax-free.

If you are regularly making charitable contributions but aren’t getting the tax benefit for doing so because you are still taking the standard deduction, you might consider prepaying your charitable contributions in the year the SARs are exercised by contributing to a DAF. For example, let’s say you are married and regularly donate $10,000 to charity each year. Because the standard deduction is $27,700 this year, you will not receive the tax benefit for your donation. Let’s also assume that you receive $200,000 in the year you exercise your SARs. You can make a $100,000 donation to a DAF, receive a large tax deduction in a high-income year to minimize your tax liability, and then can recommend grants out of the DAF for the next 10+ years until your original donation balance (plus any tax-free growth) is used.

Again, we’re treading on shaky ground here as we are not rendering tax advice but rather just outlining a hypothetical scenario. For tax advice specific to your situation, talk to your CPA.

Utilizing the Deferred Compensation Plan

Each year during the open enrollment period, you will be given the opportunity to defer compensation into the plan. You may defer up to 75% of your salary earned during the coming year. You may defer up to 100% of the bonus earned during the coming year that will be paid following the earning period. Your deferrals are credited to this plan when they would otherwise have been paid and are always 100% vested. The plan offers a variety of investment crediting options meant to provide you with choices that suit your risk tolerance and preferred asset classes. The variety of options allows you to align your fund selection and risk levels with the time frame of your goals.

When you decide on your deferral choices each year, you have the option to choose a distribution plan for the deferral balance. These decisions can be strategically timed to align with specific needs or preferred payouts, such as covering the costs of a child’s college tuition, making a significant purchase, or planning for your retirement. In-service distributions can be made payable as a lump-sum or in 2–5-year installments (can be up to a 15-year installment if elected as a retirement distribution).

Deferring compensation can lower your tax burden in the year you exercise your SARs by pushing income into future years at a lower tax rate.

Conclusion

Your Maverik SARs are close to vesting. What do you do next? In order to make sure you are taking advantage of the tax planning strategies that work best for you, let’s talk before you exercise your SARs.

Sources:

FJM. (23 August, 2019). https://fjm.retirementnq.com/how

Holistiplan. Using the DAF (Donor Advised Fund) Explainer. https://help.holistiplan.com/how-does-the-daf-donor-advised-fund-explainer-work

Roberts, Nicole. What is the best vehicle to use for charitable giving?. Rock House Financial. https://rockhousefinancial.com/financial-planning/charitable-giving/

Disclosures

Rock House Financial (RH Advisors) throughout this website has provided links to various other websites. While the firm believes this information to be reasonably reliable, current and valuable to its clients, The firm provides these links on a strictly informational basis only and cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.