Everybody knows “Uncle Sam” and how unforgiving he can be with taxes, but how many people know about “Aunt IRMAA”? In this blog we’ll talk about the Income Related Monthly Adjustment Amount (IRMAA) and Medicare.

Before we get started, we are financial advisors in Davis County, Utah and we have written these blogs:

Enjoy!

And now onto the blog…

What is the relationship between IRMAA and Medicare?

Let’s start with the definition of IRMAA.

Poorly named IRMAA has everything to do with Medicare. While everyone on Medicare pays a standard monthly premium for coverage, IRMAA simply describes the additional “tax” or surcharge that increases your Medicare premiums beyond the basic rate.

Who’s paying the extra cost?

Well, it depends on your income… from two years ago (that’s right, two years).

Why two years?

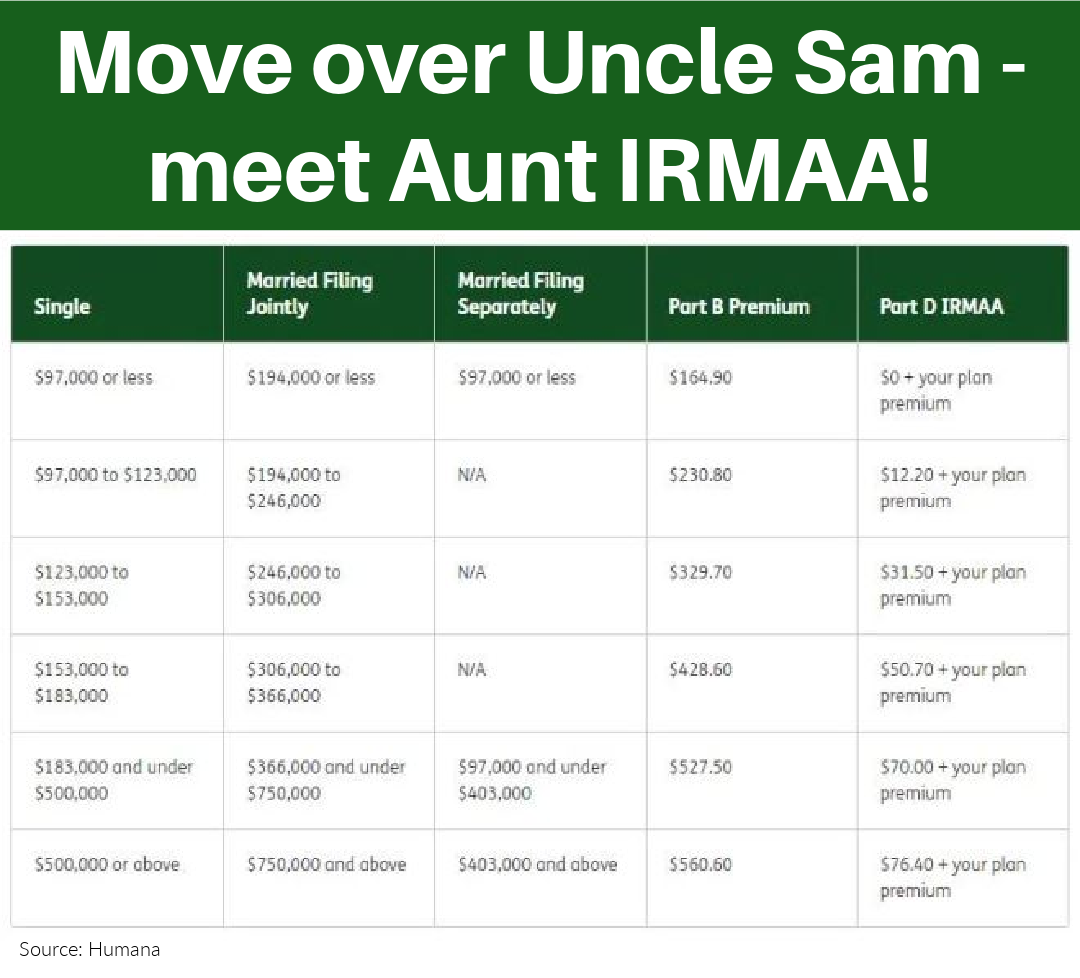

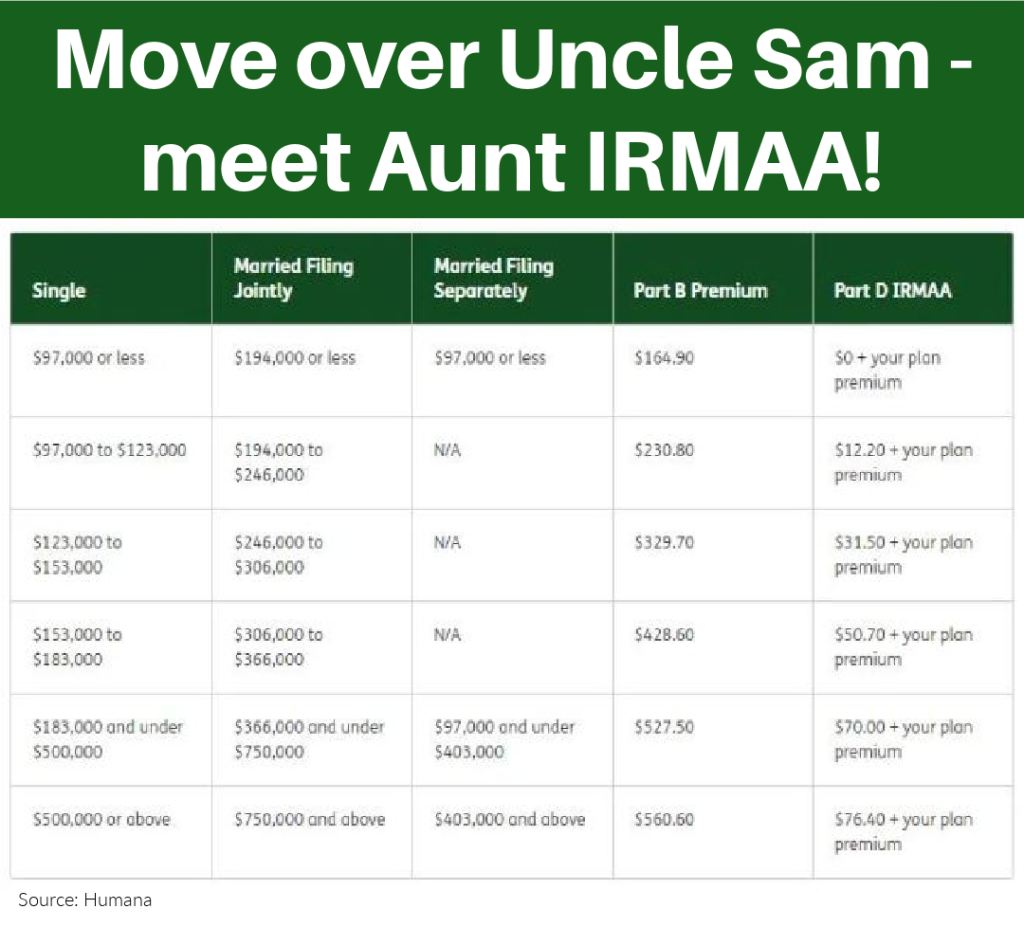

Well, “Aunt IRMAA” is old and is stuck in the past. Joking aside, the additional Medicare premium surcharge is reviewed annually by measuring your income from 2 years ago against certain income thresholds in the current year. So, your 2023 income will determine if you must pay higher premiums in 2025, your 2024 income will determine what your premiums will be in 2026, etc. It is a progressive table, so the higher your income the higher your premiums will be. The first IRMAA premium increase starts at 2021 income above $194,000 for married and $97,000 for single. See table below.

Why is all this important?

As you can see in the table, bumping up to the next bracket adds an extra cost of up to $120 each month PER person! Assuming a married couple, that’s an extra $2,880 a year for the same insurance! The unknowing retiree may take out a taxable distribution from an IRA (like a forced RMD) or sell an appreciated asset and accidentally push their income past an IRMAA threshold – and not realize it until their premiums jump two years later! Importantly, having even one penny of income over the stated threshold subjects you to the next bracket of increased premiums – no ifs, ands, or buts! While bumping into the next IRMAA bracket may be avoidable in some years, IRMAA is reassessed each year, so it always needs to be planned for.

IRMAA is becoming more problematic for retirees as it is ever more costly for the federal government to insure the health of our nation’s growing 65+ population. Premium increases are happening across the board, and it could only get more costly. It’s possible that Congress decides to fund the scheduled 25% deficit in social security benefits in 2033 by increasing IRMAA surcharges based on income. Of course, we’ll see what Congress does until then…

How do we avoid the “extra” IRMAA Medicare premium?

For some folks, their retirement income won’t push them into IRMAA surcharge territory, unless they had a large taxable event such as taking money out of an IRA for a medical expense, or for a new car. For example, the month is November, and you want to buy a new car for $50k with only $40k of income left before you bump to the next IRMAA bracket. If timing allows, such a distribution could be split amongst the two tax years – maybe $30k now and $20k in January. Ultimately, managing the extra IRMAA Medicare premium comes down to managing your income. If you have tax-free Roth money or investments that can be sold with little gain, that can be used to manage your tax. Even the cash value of a life insurance policy can be utilized, if appropriate. For example, based on your goals, it may be beneficial to do big Roth Conversions in one year, even though it will increase your monthly premium two years later. The year following, your premiums would return to normal. There are a lot of tools to assist with this management, but it’s important to consider your lifetime tax bill – not just this year’s tax bill.

Appealing your IRMAA

A lot can happen in two years and the Social Security Administration understands this. So, you do have the right to contest any IRMAA assessed. Grounds for appealing are often based on “life-changing events”. Examples include the death of a spouse, marriage, divorce, and most notably retirement.

We often recommend that newly retired clients contact the Social Security Administration after receiving their benefit determination letter to ensure that their Medicare premiums are reflective of their now lower income going forward, not based on when they were while working. This only works if you’re expecting retirement income to decrease enough to put you in a lower IRMAA bracket, if at all. Ultimately, if your income changes materially, it’s good to give them a call.

Filing an appeal is done by filling out form SSA-44, selecting a life-changing event, and then providing proof of said event. If you’ve just retired, you may need a note proving your retirement. Fair warning, our clients’ experiences in appealing are always the same, “What a hassle!”

Proper retirement income and tax planning are crucial if you want to navigate the retirement tax minefield. Please reach out to learn about how IRMAA affects you or may impact your future. If possible, Aunt IRMAA is one you will want to avoid at the summer BBQ…

Sources

Humana. Income related monthly adjustment amount (IRMAA) for 2023 Medicare Part B & Part D Premiums. https://www.humana.com/medicare/medicare-resources/irmaa

Disclosures

Rock House Financial (RH Advisors) throughout this website has provided links to various other websites. While the firm believes this information to be reasonably reliable, current and valuable to its clients, The firm provides these links on a strictly informational basis only and cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites.

The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Any opinions, projections, or forward-looking statements expressed herein are solely those of author, may differ from the views or opinions expressed by other areas of the firm, and are only for general informational purposes as of the date indicated.